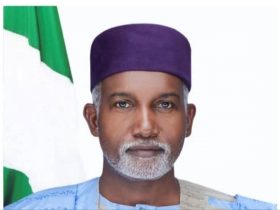

The Speaker of the House of Representatives Rt. Hon. Abbas Tajudeen, PhD, has listed ways by which the National Assembly can legislatively address the current economic challenges facing Nigeria.

One of them, the Speaker noted, is tax reforms, which he said the 10th House had already captured in its much-awaited Legislative Agenda.

Speaker Abbas made this known on Thursday at the opening of a two-day retreat for members of the Senate on fiscal policy and tax reforms in Uyo, Akwa Ibom State.

He said: “Over the years, the National Assembly has responded proactively to these issues and promoted economic reforms emphasising ease of doing business.

“We in the 10th House of Representatives intend to work with the Executive and stakeholders to improve the coherence of our tax system, both in terms of administration and operation.

“Accordingly, the Fourth Legislative Priority in our Legislative Agenda is Economic Restructuring. It captures our commitment to supporting economic diversification to reduce dependence on oil and increase development in other sectors, including mineral resource mining, manufacturing, agro-processing, textile, tourism, technology and general services.”

Speaker Abbas added that the 10th House would use legislative measures to provide incentives on tax breaks to encourage innovations, and for industries that have the potential for job creation and export growth.

“A key priority for us is to support the implementation of the African Continental Free Trade Agreement (AfCFTA) to open up markets and promote economic cooperation and growth.

“We have also prioritised developing laws that streamline business registration to make it quicker and more affordable and reduce bureaucratic red tape.

“Equally important to us is simplifying the tax system, reducing multiple taxation and offering incentives for sectors critical to growth,” the Speaker stated.

Speaker Abbas listed some pertinent questions to consider at the retreat including: How can the tax system be simplified to minimise administrative and compliance costs without undermining fiscal solvency? How can the government prioritise evidence-based studies in designing the tax structure to minimise the economic, administrative and compliance costs of taxation? And in what ways can we re-organise our revenue authority to make it function-based?

He added: “Above all, we must intensify our efforts at ensuring effective oversight of the utilisation of tax revenues to ensure that they are optimally deployed for the good of the people we represent. The connection between democracy and taxation is evident in the famous phrase ‘no taxation without representation,’ which highlights the importance of citizen participation in decision-making processes.”

The Speaker reiterated the commitment of the House to collaborate with the Senate in addressing the challenges faced by the nation through the implementation of appropriate legislative frameworks and measures.

“The House eagerly anticipates the outcome of this retreat and intends to act upon it accordingly,” he said.

The Speaker expressed delight over the relevance of the issue under consideration, which he said was immediately apparent, given the wide range of fiscal policy challenges confronting Nigeria, “which the 10th National Assembly must address expeditiously.”

Speaker Abbas recalled that the over-dependence on the oil sector, which contributes the largest share of government revenue, had been at the forefront of reforms by previous governments.

“Progress towards economic diversification has been slow, and our economy remains vulnerable to global oil price fluctuations,” he added.

The Speaker also recalled that in the past, these vacillations and slow revenue growth had resulted in budgetary shortfalls and the attendant economic and social implications.

He noted that the gap between the Federal Government’s revenue and expenses had grown four times larger, between 2015 and 2021. He said in 2023, for instance, the expected budget deficit was over N10 trillion, which is mainly being funded through borrowing.

Speaker Abbas said, “Although our debt-to-gross Domestic Products (GDP) ratio remains relatively low compared to many countries, the proportion of revenue spent on debt servicing is high, which can constrain the fiscal space for other developmental needs.

“Other challenges include inefficient tax collection, as attested to by our low tax-to-GDP ratios. Only a few weeks ago, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, disclosed that Nigeria loses about N20 trillion (about $26 billion) annually due to gaps existing within its tax system, including evasion, inefficiencies in collection modes, weak enforcement, and a large informal sector that remains outside the tax net.

“Another factor that has negatively impacted the efficiency of our tax system is the multiplicity and duplication of taxes. Suffice it to say that we have made significant progress in improving our World Bank Ease of Doing Business Ranking. For instance, in 2020, Nigeria was ranked 131st out of 190 in 2019 and against 145th out of 190 in 2019. This resulted from legislative and executive measures adopted by the government to improve the business environment in Nigeria.”

Leave a Reply