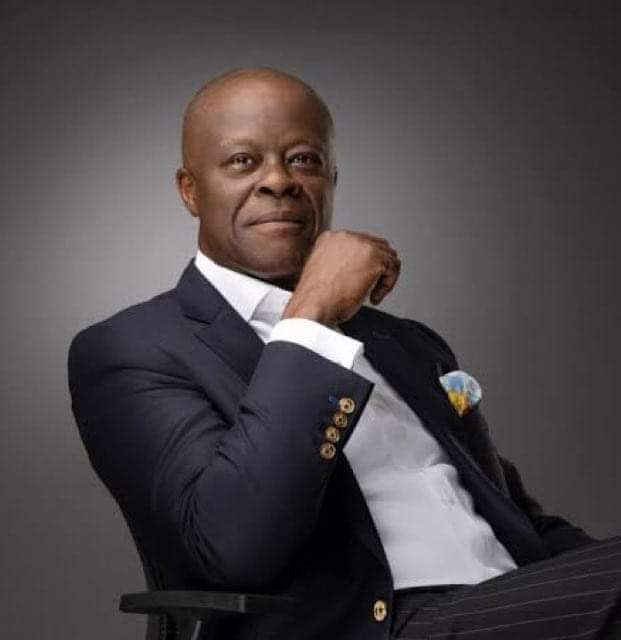

Minister of Finance and Coordinating Minister of the Economy Wale Edun has said Nigeria is currently in talks with the World Bank to secure a fresh $1.5 billion loan facility.

Edun, who disclosed this Saturday while fielding questions from journalists at the ongoing 2023 Annual Meetings of the World Bank and the International Monetary Fund (IMF) in Marrakech, Morocco, said the loan request was part of the present administration’s efforts to address the fiscal gap in the 2023 budget.

If approved, it would bring the country’s total debt stock as of June 30, 2023, to $114.92 billion.

However, experts are asking the federal government to be cautious of going further, saying the administration should rather redirect the nation’s fiscal policy and explore domestic revenue.

Addressing journalists, Edun said: “On the talks with the World Bank on $1.5 billion budget support, that is correct. The World Bank is the number one multilateral development bank helping developing countries or funding developing countries, projects programmes, and sectors.

“It has free money through either International Development Association (IDA). It is for the poorer countries and right now I think we qualify as one of the countries that can borrow in the normal window of World Bank funding but also some concessionary IDA funding and that means that effectively the interest rate will be zero.

“In this particular case, it has long been in the pipeline, and we are hoping that funding will come through soon. There is a Federal Executive Council meeting on Monday (tomorrow) that should be able to discuss this as well as other initiatives for financing on reasonable terms.

“We have talked about the high costs of money – the World Bank money is the cheapest.”

“Regarding the opportunity to attract investments, there have been many conversations and, in all honesty, the narrative is that with the bold courageous steps that Nigeria has taken, we are now at the forefront, almost number one on people’s list when they want to look at where to invest; that is now the narrative.

“Nigeria is definitely on the right path; we have taken the right decision for the economy to recover and for it to attract Foreign Direct Investment (FDI) and as well, I will add, domestic investment to recover full economic growth, job creation and at the same time, achieve inclusivity of women and young people.

“We’ve talked about tax reform, and that tax reform will include looking at expenditures on taxes, waivers, duties, and tax exemptions. So, that is very much part of the plan,” he added.

…Ways and Means

On the Ways and Means, the minister explained that the present administration will not go beyond what is permissible by the law.

“Regarding Ways and Means, President Bola Ahmed Tinubu, even while campaigning as a candidate, President-elect and President, commits not to go beyond the statutory limits.

“One of his priorities is the rule of law – sticking to agreements, sticking to the law. And so, his commitment is to come within the limit for Ways and Means, which essentially means overdraft borrowing from the Central Bank.

“However, having made that commitment and given that direction of travel, I think the idea and commitment is to come within whatever is the statutory limit as soon as possible.”

…Nigerians react

In a reaction, a political economist, Adefolarin Olamilekan, advised the federal government to seek new ways to mobilise resources domestically and jettison the idea of foreign loans.

Adefolarin told Blueprint that the $1.5 billion would further raise the country’s debt stock just as he wondered if the government would be going back on its resolve to avoid borrowing to fund the budget deficit.

He said: “Unfortunately, with the current debt burden on the nation alongside other implications on our foreign reserves, the depreciating naira and long-term impact on economic growth. Instructively, the Tinubu APC government needs to refocus its fiscal strategy policy toward domestic revenue generation to avoid proclivity for foreign loans just like successive governments in the past.

“Nigerians would not be surprised if the federal government eventually secures the loan. The sad part of it is the promise made by President Bola Tinubu when he inaugurated the presidential committee on fiscal policy and tax review some months back.

“The president maintained that we look inward to generate funds. The question is what has happened to the plan of sourcing funds domestically, that the Tinubu administration like his predecessor is now seeking for loan.”

He urged the government to “address the challenges of budget gaps and deficit, noting that failure to adhere to due process, transparency and budget corporate governance pushed the country to the difficult position it now finds itself in.”

But in his advice, an economist, Friday Efih said the federal government should be transparent in the use of the loan.

Speaking to this reporter on the telephone, Efih said that he would rather wait to hear from the minister to see where the money would be channelled.

“I just hope that we will not return to the Buhari days where the government borrowed at every opportunity.

“My only worry is that our debt servicing has just risen even in the face of low revenue,” he said.

Credit: BluePrint

Leave a Reply